CWT AMC Customer Portal & ERP

CWT Asset Management Company (AMC) is a prominent asset manager in Bangladesh. It currently has 4 funds – CWT Opportunities Fund, CWT Sadharon Bima Fund, CWT Emerging Bangladesh Growth Fund, and CWT Community Bank Shariah Fund. In the future, CWT AMC has plans to open for funds. We created a Customer Portal and an ERP system for CWT Asset Management Company (AMC). The portal allows customers to track funds, invest, and upload payments. The ERP makes the KYC process, fund transfers, and broker settlements easier, while automatically calculating portfolio values and journal entries, improving both customer experience and operational efficiency.

Project Overview

CWT AMC wanted us to build two things. One is the self-service customer portal and the other one is an ERP for their back office.

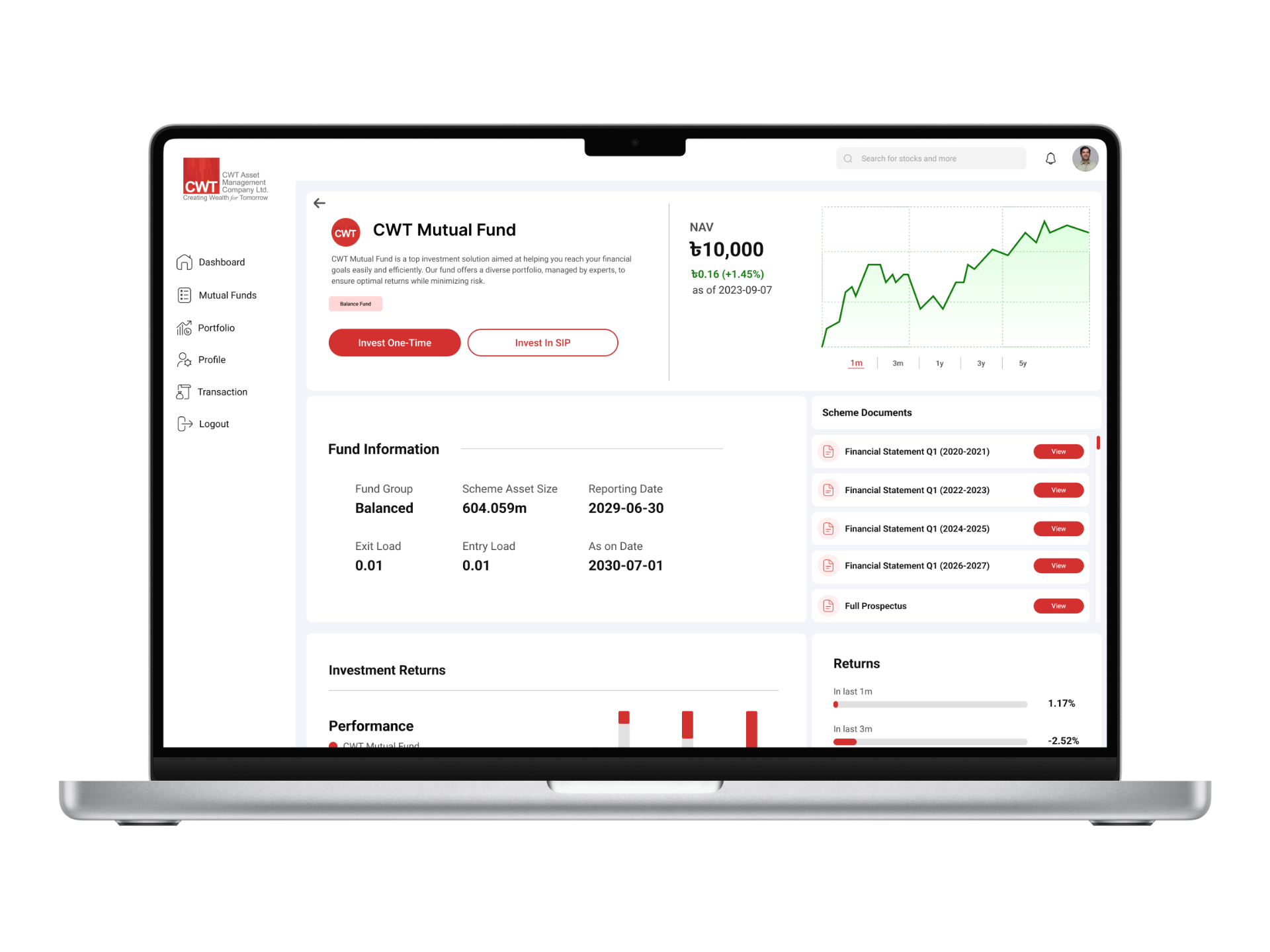

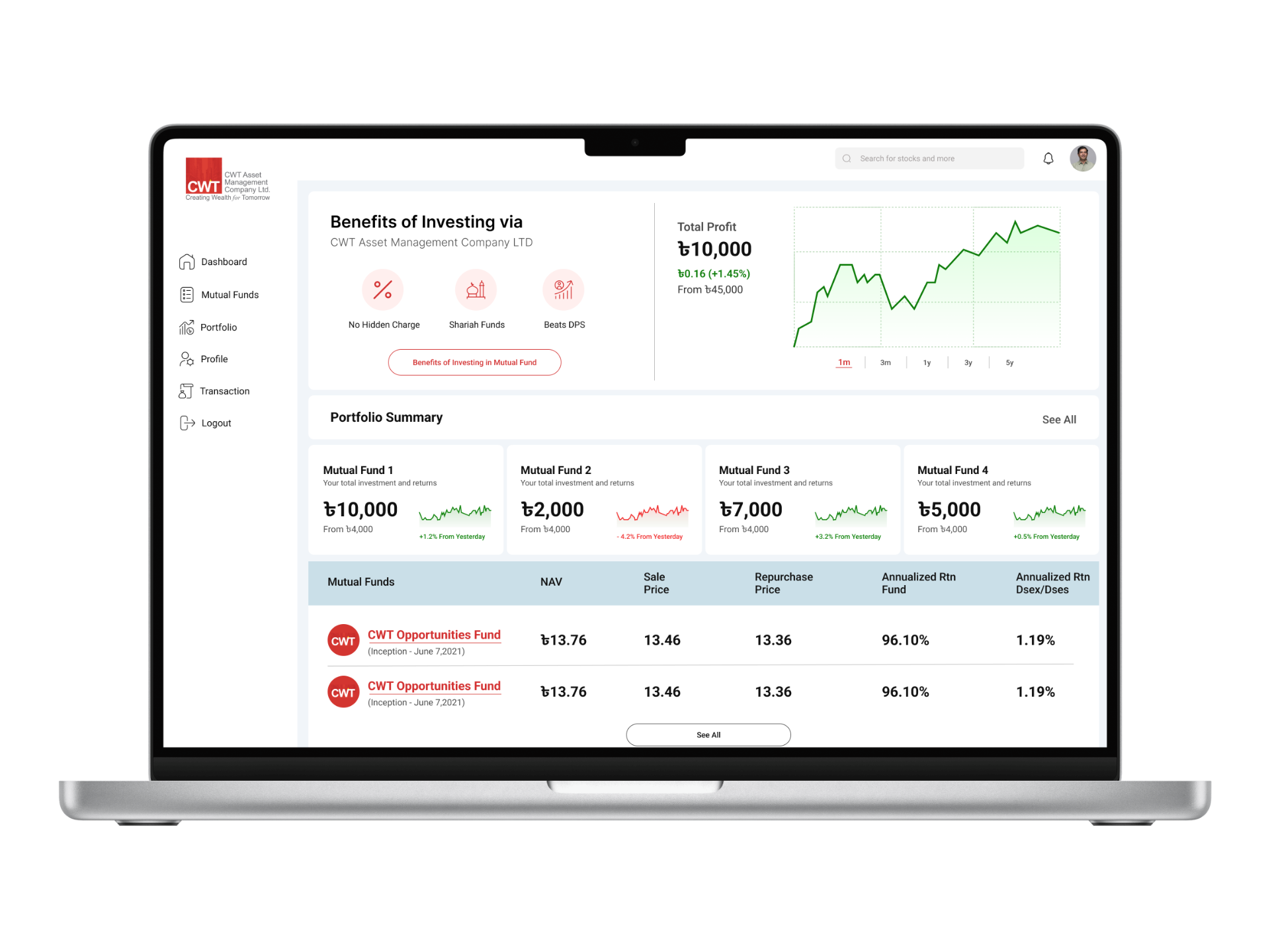

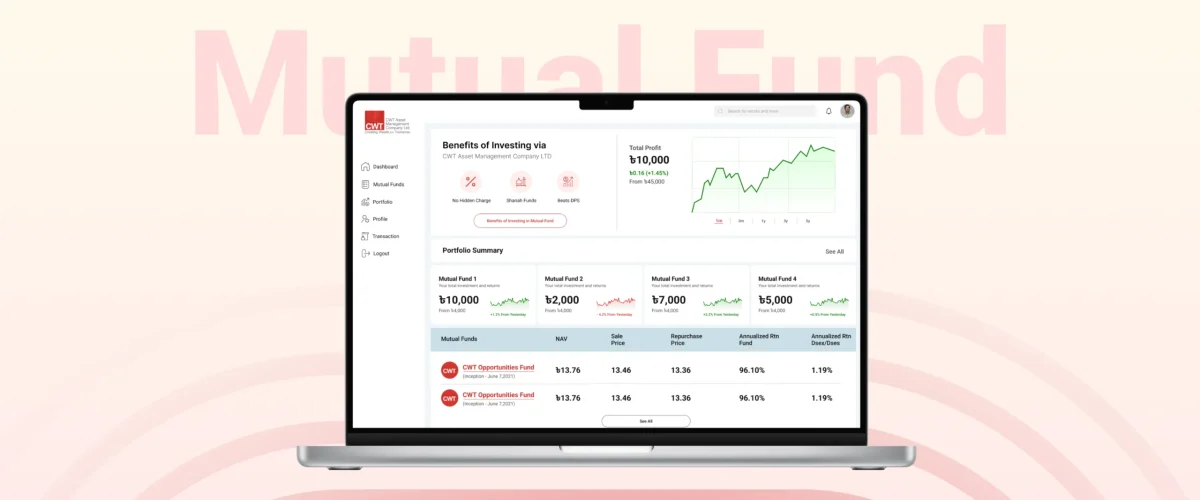

The CWT’s customer portal is a system where customers can sign up and see the latest NAV of each fund, and see the fund profile (performance, positions it holds, information about the fund). And, then customers can invest either lump sum or through SIP. Customers can also sell their investments. When it comes to payment, it’s a semi-manual process. The bank details of the fund are provided in the portal. Customers can transfer the funds through online banking and upload the fund transfer document in the portal.

When customers apply for KYC, it was done manually previously. Customers come to the office with documents or someone goes to the customer’s home to collect the document. Later on, that person would scan the document and keep it in the file. These data were manually entered in the Excel file to keep a record. But now with the help of the new system, customers can do this through the portal. When a KYC entry is created, the AMC checks the information. If something needs to be changed they disapprove of the KYC with a message. Then customers get an alert, Then, the customer can resubmit the KYC request with updated documents. When customers transfer funds, the back office gets a notification. Then, they check and send payment recognition to customers. Settlement with brokers is also done through the back office.

CWT AMC has multiple BO accounts. When buy or sell happens using these accounts, the data needs to be entered into the ERP system manually. The ERP system then calculates the portfolio value, gain or loss, and returns at the end of the day automatically. Journal entry becomes almost automated as interest from banks, dividends from stocks, etc. are created in the ERP system. With this information, the accounting module in the ERP system makes account preparation much easier.

The Challenges

- Figuring out the best ERP Framework

- Learning Frappe in a short period of time

Approach

We have used the following technological stacks to complete this project:

- Backend: ERPNext

- Customer Frontend: ReactJs

Process Overview

- First, we completed a detailed Figma design of both the customer content portal and the back office.

- Then, we did detailed research to figure out what is the best ERP framework for this particular problem. We chose ERPNext as we wanted to keep the process economically efficient. So instead of paying the per-user fee, we took the cloud cost. We also considered Odoo but it isn’t fully open source and requires a per-user fee to use the premium features. ERPNext is easily modifiable and this type of system needs to be modified easily. This is another reason why we chose ERPNext.

- Modification of the framework required us to learn Frappe deeply because ERPNext is written using Frappe. To modify, the team needed to code using raw Frappe. So, the team learned Frappe in a very short period to build the backend of the customer’s front end.

- We have also added a reporting module in the ERP system that helps CWTAMC automate its regulatory reporting.

Technical Innovations

- We have made the mutual fund investment process easier for CWTAMC customers through the customer content portal.

- Portfolio management has become hassle-free for CWT as their calculations are now automatically done through the ERP system. Journal entries for dividends, interest, and other transactions are generated in the ERP system, simplifying account preparation.

- Back office operations are now easier as notifications for KYC and buy/sell are sent ensuring it is done in the shortest time possible. This helps to provide a smoother onboarding experience to the customer.

With the new CWT Customer Portal and ERP system, CWT has successfully improved both customer experience and internal operations, making the investment process smoother and more efficient. If you’re looking to optimize your financial systems with user-friendly and effective solutions, reach out to us today to explore how we can help your business!

Still have questions?

Schedule a call with us today.

Our team is here to provide answers and guide you every step of the way.

Still have questions? Schedule a call with us today.

Our team is here to provide answers and guide you every step of the way.